[GUEST POST] The Case for the “Adult Gap Year” Plus 6 Financial Steps to Take Before Embarking On Your Own

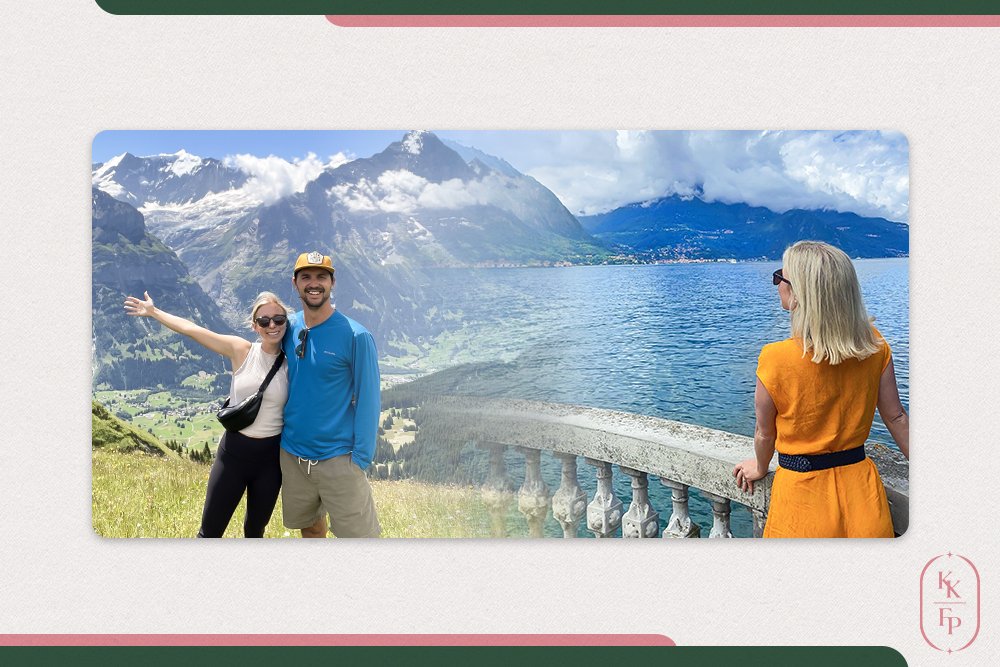

This month I have the absolute pleasure of welcoming Rachael Levine aka The Tripping Millennial as a guest author! Rachael and her husband spent the past year living abroad, visiting 30+ countries around the globe. I couldn’t wait to ask her to share her experience and how they prepared financially for this trip. Enjoy!

-Kelly Klingaman

Many of us are familiar with the concept of a “gap year.” This coming-of-age experience is prevalent in Europe and Australasia, providing high school graduates the opportunity to see the world before entering university and, subsequently, the real world. Given that the typical gap year traveler is around 18 years old, this time is usually associated with backpacking, hostels, partying, and a general air of free-spirited, budget travel.

It is undoubtedly more common for Americans to follow a more traditional path, moving from education to career without interruption. Most travel during our earning years is squeezed into busy schedules via limited PTO, with the luckiest of us enjoying a few weeklong vacations each year at most. Our greatest travel aspirations are typically saved for retirement, and travel is unsurprisingly one of the most oft-cited reasons for why people save and invest their hard-earned money. For many, “living their best life” includes some form of travel, but that best life is far in the future.

While taking a year off during your career may be just as counterculture as taking one before it begins, there is growing popularity around the concept of an “adult gap year.” The adult gap year is generally defined as a deliberate career break in your 20s or 30s to self-reflect, explore new places, and experience new cultures. This trend is particularly strong amongst millennials, who may be experiencing career burnout and have shifting attitudes towards the traditional life path and the role of work.

Last month, I returned home from my own adult gap year experience. In May 2022, I resigned from my position at an investment firm, boarded a one-way flight, and traveled the world for a year with my husband. We visited a whopping 33 countries and created a lifetime (or two) of memories that I will forever cherish.

This year-long break allowed me to reassess my priorities, gain valuable new perspectives, test out new skills, and make intentional decisions about my future. I am grateful to have taken this pause at age 28 instead of age 18, which afforded me a significantly different, more comfortable, and less alcohol-laden experience than I may have had back then. I cannot recommend this experience enough and hope the trend continues to gain steam.

While an “adult gap year” comes with innumerable life-altering benefits, it also comes at a cost. Here are six tips to consider before embarking on your own gap year:

1. START SAVING NOW

Setting a travel budget for a full year is no simple task. Everyone travels a bit differently (for example: are you a hostel person or a five-star resort person? street food or Michelin-starred restaurants? budget airline, or first-class flier?). When determining our budget, we used apps like Mint to track our spending and our average monthly cost of living at home.

We planned to save up a travel budget that was similar to or lesser than our average monthly expenses in Austin, and that may be a good place for you to start as well. Also worth considering are the types of destinations you plan to travel to and when you plan to travel to them.

For example, many countries in Europe are pricier to visit than countries in South America or Southeast Asia. Similarly, traveling to well-known destinations like Spain, Italy, and France during the high-season summer months is often more expensive (and more crowded) than traveling during the shoulder season. Once you determine your travel budget, aim to add about 20-25% to that figure. This is to account for unexpected travel costs and/or provide an extra financial cushion to support you when you return home and begin searching for your next role.

2. QUIT YOUR JOB WISELY (OR DON’T AT ALL)

For many, embarking on an adult gap year involves a complete career break: AKA quitting your job. That said, the nature of work today means more remote opportunities than ever. Keep in mind that you might not have to quit your job to travel the world, and earning an income while working remotely abroad can make the financial part of this equation much simpler.

If you do plan to quit, however, be mindful of when you choose to leave as well as any financial benefits you may be leaving on the table. For example, is there a bonus you might be forfeiting by leaving a month or two too soon? Also, consider more aggressively contributing to your 401k or HSA in the months leading up to your departure to capture as much of your match as possible. While every job is different, the timing of and decisions made around your departure can mean a difference of thousands of dollars.

3. FOR YOUR HEALTH

For most Americans, health insurance is accessed through our employers. That means breaking up with our employer is, unfortunately, breaking up with our coverage. Before you leave, schedule and complete as many necessary doctor appointments as possible to get the full value of your existing health plan: i.e. get that physical, visit the dentist, schedule an eye exam, etc.

If you have prescriptions that you take regularly, talk with your doctor, pharmacy, and/or health insurance provider about getting a bulk quantity that you can take on your travels. Finally, after you leave your job, I recommend purchasing an international health insurance policy that will cover you wherever you roam.

4. HOUSING & OTHER ASSETS

Housing is one of the highest costs and considerations before taking an adult gap year. If you are renting, consider timing your departure so that your lease ends close to when you leave, or find someone to sublease your space while you are away. If you are a homeowner, consider renting out your space to long-term renters or listing it on short-term rental sites like Airbnb or VRBO. (We listed our home on Airbnb to make up some of our mortgage payment, ended up making a little profit, and put that money towards our travel experience).

Of course, leaving the country means you will likely be leaving much of your stuff behind. Some people opt to sell most of their belongings as a way to rid themselves of physical constraints as well as generate additional income for their travels. For example, while we chose to keep most of our things, I did decide to sell my car just before the trip. Others may need to search for temporary storage solutions if they are moving out of their place.

5. CREDIT CARDS ARE YOUR FRIEND

If you don’t already have a travel credit card, there is no better time to get one than now. Travel credit cards not only earn you points rewards that enable free (or heavily discounted) travel, but they also provide meaningful perks to make your travel experience easier such as purchase protection, travel insurance, no foreign transaction fees, airport lounge access, and more.

Remember that most travel credit cards typically include some kind of annual fee and a minimum spending requirement in the first few months to achieve the advertised new signup points bonus. If you aren’t sure where to start, I recommend checking out the Chase Sapphire Preferred, Chase Sapphire Reserve, or American Express Platinum cards.

6. CONSIDER INVESTMENTS & LONGER-TERM GOALS

Taking a break from your career doesn’t mean you should take a break from your broader saving and investing goals! If it is financially feasible for you, I suggest building a plan that allows you to continue contributing to savings, retirement, and/or brokerage accounts while you are away.

-Rachel Levine, The Tripping Millennial

If you’d like customized help using your financial resources effectively in order to make the most out of your wealth-building years, please schedule a free consultation here or email me with questions kelly@kkfp.co

Be sure to follow along on Instagram @kkfinancialplanning for free educational content and sign up for my monthly(ish) newsletter to access the free guide, “7 Questions Professional Women Should Ask Before Hiring a Financial Planner”. When you subscribe, I’ll also keep you up to date on KKFP’s blog posts, video content, educational webinars, and more.

Disclaimer: This blog post is not intended to be a substitute for specific financial, tax or legal advice. The article is for general informational purposes only. Reproduction of this material is not permitted without written permission.

© 2021 Money Quotient, Inc. All Rights Reserved. First Step Cash Management System™is owned by The Planning Center, Inc. and distributed via licensing arrangements with Money Quotient, Inc.